Financial Wellness Summer Series

No pressure. No judgment. Just a safe place to build a better relationship with your money.

This is a gentle, practical money series for single-income households and people in transition.

Does It Feel Like No Matter How Hard You Work, You Never Have Enough?

You’re not alone. Many hardworking Belizeans find themselves in the same cycle, paycheck after paycheck, with nothing left to show for it.

Money should provide freedom, not stress. Yet, for many Belizean households, financial security feels impossible.

The bills stack up faster than your paycheck lasts, unexpected expenses drain your account when you least expect it, and when you try to budget, something always throws you off track.

As a result, you feel overwhelmed, frustrated, and unsure of how to break free. Does this sound like you? Well, here’s the thing…you are NOT irresponsible and you are NOT bad with money. It’s just that no one ever taught you how to make money work for YOU, but that ends today.

Imagine Waking Up Without Financial Anxiety

What if you could…

- Check your bank account without feeling panic?

- Go out without feeling guilty about spending?

- Save money every month, without depriving yourself?

- Finally take charge of your finances instead of always playing catch-up?

Feels good, doesn’t it? This is what financial peace feels like. And you don’t have to be “good with money” to get there, you just need the right plan.

Who Is This For?

- If you’re tired of feeling stuck in money stress and financial frustration.

- If you work hard but still feel broke before payday.

- If you want to save, but there’s never any money left after bills.

- If you’re tired of feeling guilty every time you spend.

- If you feel like no one ever taught you how to manage money properly.

If you’ve said “YES” to any of these, then this is for you! The good news is that you don’t have to do this alone. Let’s build your money plan together and start your journey. Schedule a consultation today.

Why Do I Struggle?

Most people think financial success comes from making more money. But it’s not about how much you make, it’s about how much you keep In other words, more income won’t solve your financial problems if you don’t know how to manage what you already have.

Here’s the hard truth:

- Budgeting apps can’t fix bad money habits.

- YouTube videos don’t hold you accountable.

- Reading finance books won’t help if you don’t take action.

Get Your Free Expense Tracker

What You’ll Get with Inner Peace Financials

This isn’t another “one-size-fits-all” budgeting plan or 1:1 Coaching. This is a personalized roadmap to help you gain financial stability, without unrealistic restrictions. Here’s what we’ll do together:

- Create a simple, customized budget that fits your lifestyle.

- Show you how to save more & pay off debt, without feeling stuck.

- Help you take back control of your finances, without guilt or overwhelm.

- Keep you accountable so you don’t fall back into old habits.

To show you how much I am committed to your success, I will give you my detailed Expense Tracker for FREE to get started!

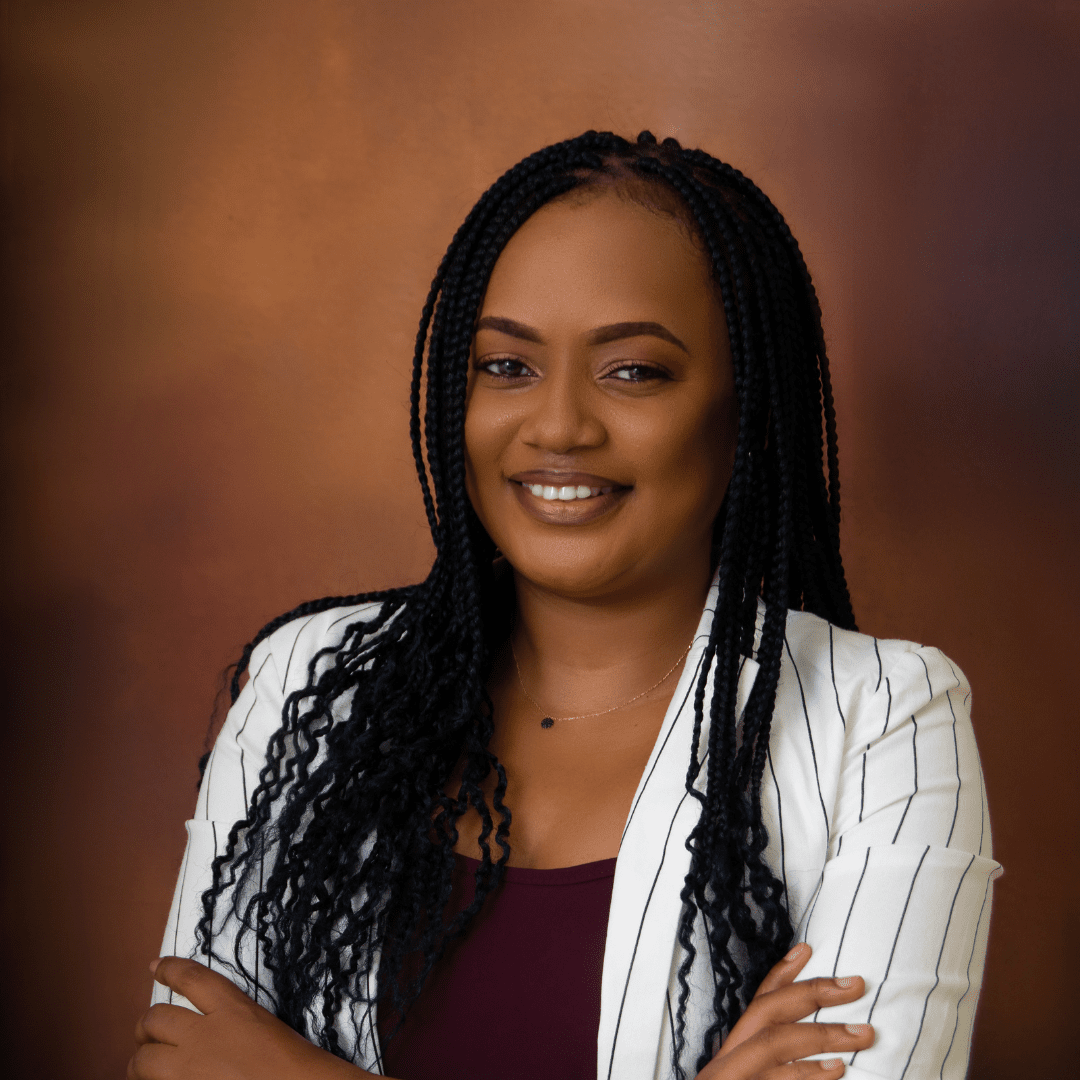

Meet Nicolyn "Nic" Raymond

As a financial wellness speaker, financial educator, and advocate for financial wellness, I understand these struggles firsthand. I’ve worked with professionals just like you who once felt stuck but transformed their financial habits into strategic, stress-free wealth-building practices.

Through personalized coaching, workshops, and structured financial planning, I offer a step-by-step approach to help you shift from surviving to thriving. Whether you’re balancing a household on a single income, rebuilding after a major life change, or simply looking for a smarter way to manage your money, I’m here to guide you.

You don’t have to figure this out alone. Let’s build a financial plan that gives you confidence, clarity, and control over your future.

The Cost of Waiting vs. The Cost of Taking Action

Every month you wait, you’re losing money and peace of mind. Here’s what waiting is already costing you:

- Overdraft Fees: $35+ per month.

- Impulse Spending: $150-$300+ per month.

- High-Interest Debt: $100s or $1,000s per year.

Here’s what financial coaching gives you instead:

- More money in your pocket every month.

- A clear plan to stop feeling financially overwhelmed.

- A future where you feel safe, secure, and stress-free about money.

Here's Your Reality...You’re Either Building Wealth or Losing It!

Every day, you’re making financial decisions that are either moving you closer to financial peace OR keeping you stuck in the same cycle. Waiting around to “figure it out later” means you’ll be in the exact same place next year as you are right now. Hoping that things will magically improve isn’t a strategy and the worst of them all, not making a decision is still a decision, the decision to stay stuck.

You deserve to feel financially secure, and that starts with the choices you make today. Take Control and Schedule a Free Consultation Now!

The P.E.A.C.E. Budgeting Method™

A practical, step-by-step approach to budgeting that focuses on financial clarity and long-term sustainability.

Practical – Real-world strategies designed for busy professionals & families

Empowering – Knowledge-driven tools to help you make informed decisions

Actionable – Clear steps to move from financial stress to stability

Customized – Budgeting solutions tailored to your unique circumstances

Easy-to-Maintain – A simple, effective framework for lasting financial health

Real People, Real Transformations

-Just For You-

Most In-Demand Service

My Services